As women, we wear many hats in the roles that we play out during our lifetime.

In our lives as wives, lovers, mothers, caregivers, daughters, employees, and friends, women have become adept at keeping everything on schedule and moving forward to the point that it has become second nature.

Maybe it’s hardwiring or socialization, but for whatever reason, women have become so good at juggling our many responsibilities that we often don’t give ourselves enough credit for our ability to make our lives and the lives of those around us more comfortable and well-organized.

Would you be surprised, then, to hear that these skills that come so easily and naturally to us as women may be our hidden superpower?

Our Financial Superpower

Years of developing the functional habits that have helped us master our day-to-schedules and get us through the day smoothly are proof that women have it in them to lead a happy and successful financial life. This approach is the key to getting yourself on track to a solid financial plan.

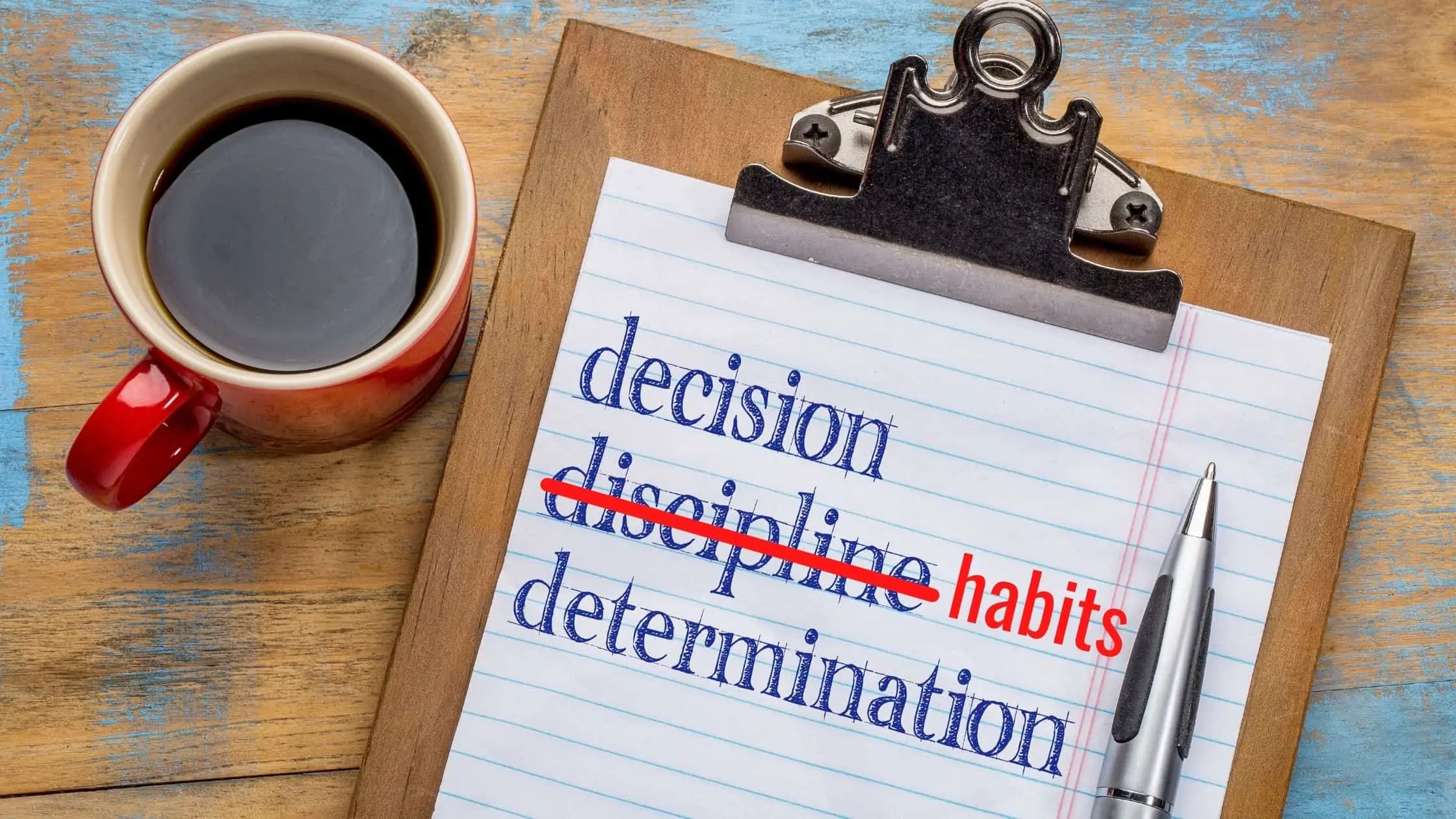

However, it all seems to fall apart for many of us when we are tasked to sit down and look at formulating a financial plan by using a single and limited lens: discipline.

Why Is Financial Discipline So Difficult?

Discipline can be a dreaded and uncomfortable word for many women particularly when it comes to the financial space because it is associated with rules and rigidity. For many women, the word “discipline” can imply that there is one, and only one, solid path to accomplishing a goal. It’s a yardstick that can conjure up tremendous insecurity, not to mention unnecessary feelings and unfounded thoughts.

Why haven’t I saved thousands of dollars by now? Or taken a dozen luxurious vacations? Why haven’t I taken the time to set aside an education fund for my kids?

The word discipline can be an underminer and can lead to thoughts that make many women feel like failures even before they start. Or they feel like they can never measure up, and this is no way to feel! Ever.

I want to help my clients stop this type of thinking in its tracks.

I believe that there is a better way of thinking, and it’s one that I have adopted into my own life – especially when it comes to my financial well-being. And it’s this: When it comes to transforming your money mindset, focus on your habits and let go of the discipline.

Getting in the Habit

Let’s first get clear on WHAT exactly a habit is in the financial world. Like the traditional definition, a habit is something we incorporate into our daily lives and routines that produces a positive result. And there is no better way of knowing what our habits are – both good and bad – than by tracking our spending.

Tracking your spending allows you to see where your money is going. Then you can put your money into categories: this month, I spent X on clothing, I spent X on eating out, and I spent X on groceries. From there, you can understand what you are spending and create a cash flow system which is one of the most guaranteed ways (and a necessary foundation) to change your financial life.

These habits will help you tell your money where to go instead of your money going wherever it wants to. The habit creates the result – not the discipline. When you create a regular habit, you are already demonstrating discipline towards the end result. See the difference?

Money Management Can Be Simple

I’m all about changing how women relate to money by making it simple.

Once we get started, I’ll get you to start focusing on your actual habits and not on the concept of discipline. I want you to solve your money problems, after all, and not hide from them. When we focus on developing empowering habits and let go of trying to be disciplined, our mindsets shift and we’re off to the races. This is our true superpower!

If this distinction between discipline and habits makes sense to you, let’s talk! You can book a FREE Clarity call with me right here, and we’ll get started on forming healthy financial habits that will change your financial future.

Did you like this article? You may also like:

Women and Financial Coaching: A Perfect Fit

Cash Flow Clarity: 5 Questions To Help You Manage Your Money